Image source: Getty Images

The UK stock market is having one of its best years to date as leading British companies continue to thrive. Popular mining firm Anglo American (LSE:AAL) rose 21% this past week, following one major bid rejection and news of other possible offers from Rio Tinto or Glencore.

NatWest Group was second-strongest to help drive the gains, climbing 11% in seven days and nearing a fresh five-year high. The high street bank has now recovered almost all the losses it incurred throughout last year – and in half the amount of time.

Barclays, Ashtead Group and AstraZeneca made up the rest of the top five weekly performers, each adding around 9.5%.

FTSE 100 taking the lead

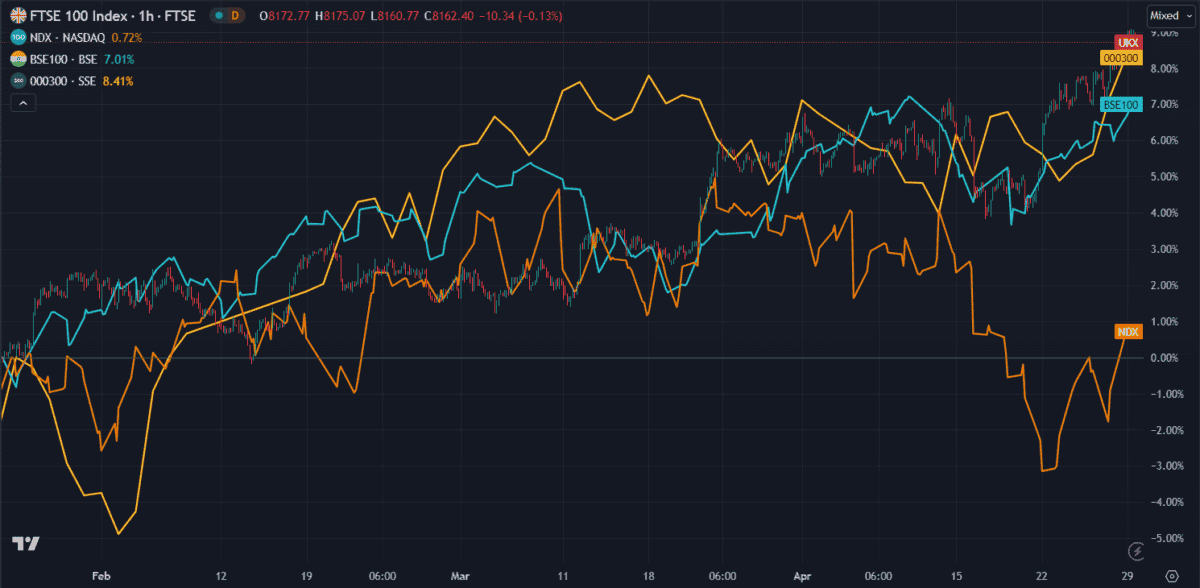

Reaching 8,189 points in late Monday trading, the FTSE 100 is making headlines globally. The sudden growth means the UK’s core index has outperformed several global indexes year-to-date.

The move didn’t go unnoticed by asset manager AJ Bell, stating: “Shifting 0.4% higher to 8,175, it means the FTSE 100’s year-to-date performance (+5.7%) is now better than…