Investors at Vanguard and Columbia Threadneedle believe market leadership could soon rotate.

Long-term investors should be looking for opportunities outside of the narrow band of stocks that have been responsible for the bulk of 2023’s performance, analysts have warned, as the market could flip again.

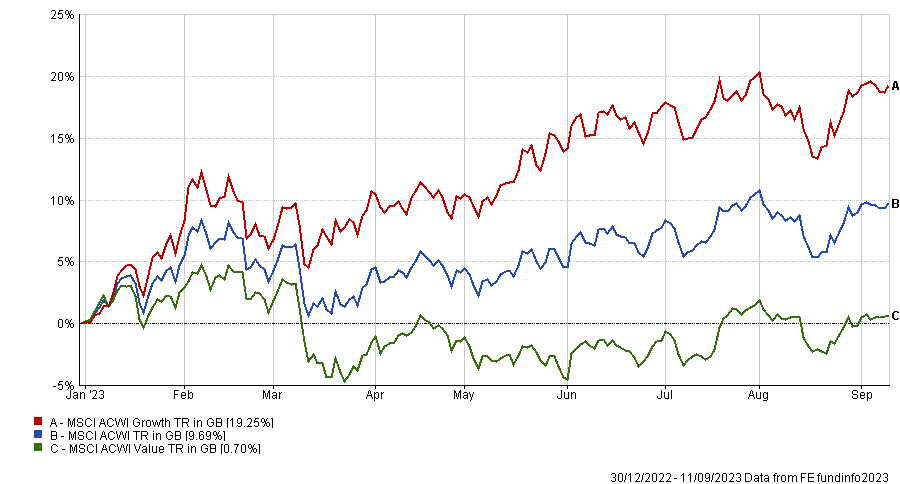

The MSCI AC World index has made a total return of just under 10% over 2023 so far but, as the chart below shows, growth stocks have made around double this. Value stocks, on the other hand, are up by less than 1%.

Performance of indices over 2023

Source: FE Analytics

Adam Norris, an investment analyst in the multi-manager team at Columbia Threadneedle Investments, pointed out that this situation has been in play for a number of years now after growth stocks – especially those in the US large-cap tech space – thrived under the era of ultra-low interest rates. While they tanked in 2022, they have bounced back this year on the back of excitement around artificial intelligence.

Over the same past years, the S&P 500 has been the leading major stock market, delivering returns…